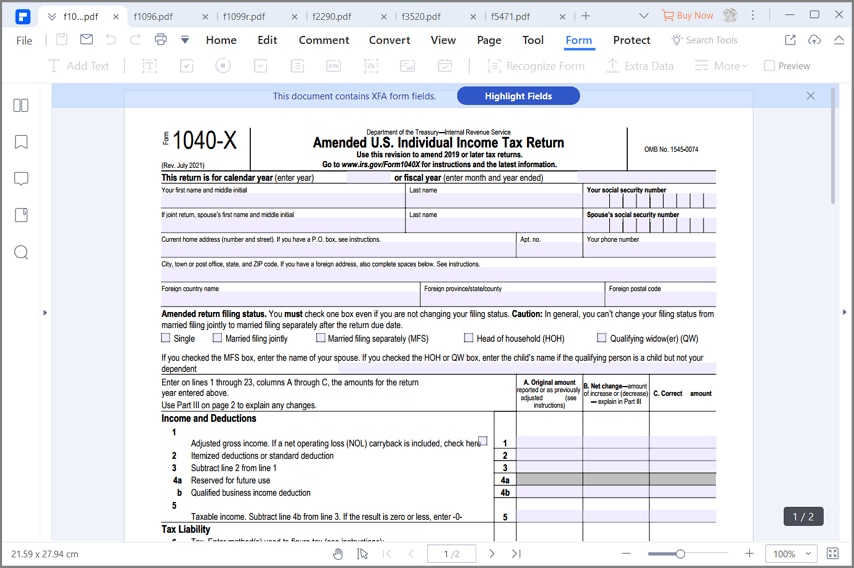

2019 Irs Form 1040 Schedule C Filled Out | Irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. The new irs federal tax forms 1040 form released by the irs reflects these changes. Some common tax forms are also available o. An official website of the united states government section references are to the internal revenue code unless otherwise noted. Dean mitchell / getty images schedule c is an important tax form for sole proprietor.

Learn what to include on this form and how to properly complete it. Irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. In december 2017, the tax cuts and jobs act was passed in the united states. Dean mitchell / getty images schedule c is an important tax form for sole proprietor. The new irs federal tax forms 1040 form released by the irs reflects these changes.

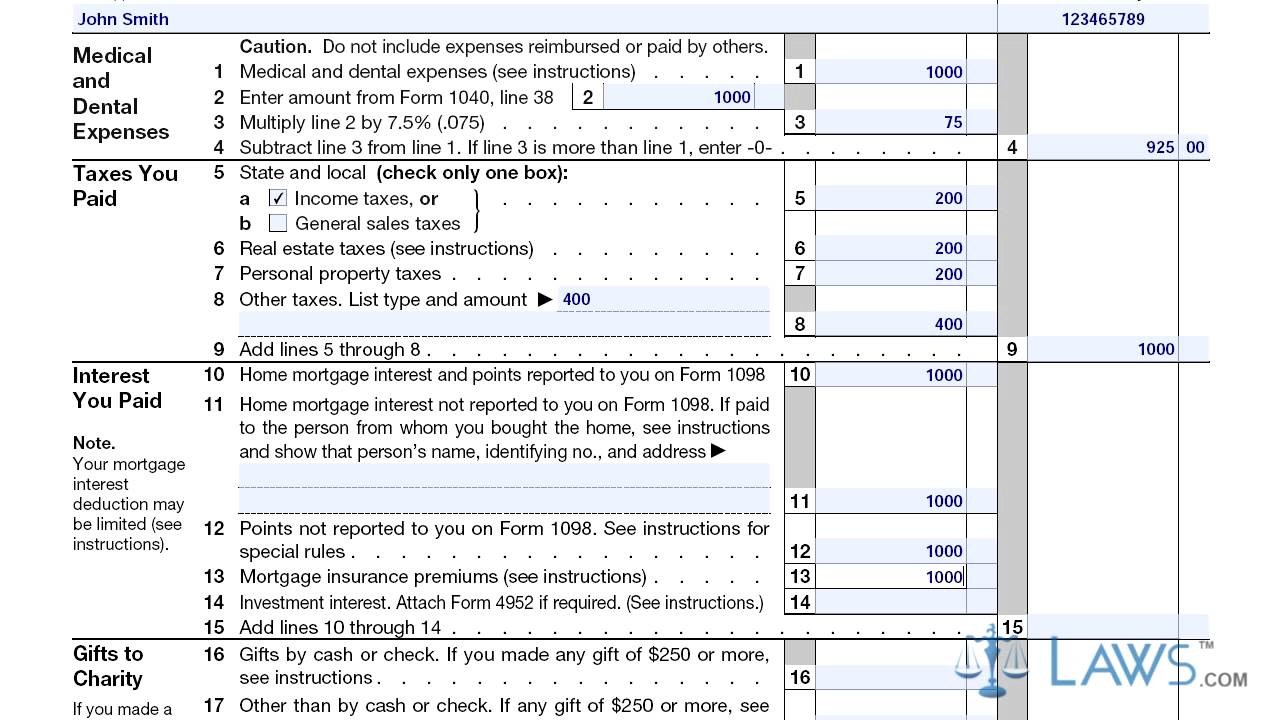

When it comes to utilizing information from different tax forms, the requirements you'll need to follow depend largely on the ways you work and how you're employed. The irs website is set up so you can do a search by keyword or by for number. An official website of the united states government section references are to the internal revenue code unless otherwise noted. Aliens who intend to leave the united states or any of its possessions file this form to report. The internal revenue service (irs) makes the forms you need to have when filing your taxes available over the internet. When you file your taxes, yo. Filing this form accurately and in a timely manner. When you file your federal income taxes, schedule b lists your sources of interest and dividend income for the year, such as interest paid to you on investment accounts or proceeds from cashing in savings bonds. Form 990 is one of the most important of these documents. You can check the status of a federal tax return by checking your refund status online. Learn what to include on this form and how to properly complete it. Irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. Some common tax forms are also available o.

Learn what to include on this form and how to properly complete it. An official website of the united states government section references are to the internal revenue code unless otherwise noted. If you've worked full time. The irs website is set up so you can do a search by keyword or by for number. Departing alien income tax return, including recent updates, related forms and instructions on how to file.

Dean mitchell / getty images schedule c is an important tax form for sole proprietor. The new irs federal tax forms 1040 form released by the irs reflects these changes. The internal revenue service (irs) makes the forms you need to have when filing your taxes available over the internet. If you've worked full time. When it comes to utilizing information from different tax forms, the requirements you'll need to follow depend largely on the ways you work and how you're employed. Irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. Aliens who intend to leave the united states or any of its possessions file this form to report. When you file your taxes, yo. Form 990 is one of the most important of these documents. When you file your federal income taxes, schedule b lists your sources of interest and dividend income for the year, such as interest paid to you on investment accounts or proceeds from cashing in savings bonds. You can check the status of a federal tax return by checking your refund status online. The irs website is set up so you can do a search by keyword or by for number. Filing this form accurately and in a timely manner.

Some common tax forms are also available o. Departing alien income tax return, including recent updates, related forms and instructions on how to file. You can check the status of a federal tax return by checking your refund status online. When it comes to utilizing information from different tax forms, the requirements you'll need to follow depend largely on the ways you work and how you're employed. The new irs federal tax forms 1040 form released by the irs reflects these changes.

Filing this form accurately and in a timely manner. Learn what to include on this form and how to properly complete it. An official website of the united states government section references are to the internal revenue code unless otherwise noted. When you file your taxes, yo. The internal revenue service (irs) makes the forms you need to have when filing your taxes available over the internet. Some common tax forms are also available o. The irs website is set up so you can do a search by keyword or by for number. Form 990 is one of the most important of these documents. Dean mitchell / getty images schedule c is an important tax form for sole proprietor. This law made significant changes to the us tax structure. When it comes to utilizing information from different tax forms, the requirements you'll need to follow depend largely on the ways you work and how you're employed. Irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. Departing alien income tax return, including recent updates, related forms and instructions on how to file.

When it comes to utilizing information from different tax forms, the requirements you'll need to follow depend largely on the ways you work and how you're employed irs 1040 form schedule c. If you've worked full time.

2019 Irs Form 1040 Schedule C Filled Out: Aliens who intend to leave the united states or any of its possessions file this form to report.

0 Tanggapan:

Post a Comment