Request To Waive Penalty | Перевод контекст waive the penalty c английский на русский от reverso context: If the request for penalty cancellation is denied, the ttc will respond to the taxpayer explaining the reason for the denial. First time penalty abatement can be filed with irs in three different ways. If you disagree with our decision, you can request a redetermination hearing. When their chances of getting the extra penalties and interest waived is slim, people often wonder what they should do if they cannot pay the total amount in one payment.

Each request to waive or abate the payment of a penalty must be made in writing to the chicago department of finance and accompanied by (1) a written explanation of the reasons why reasonable cause exists and (2) supporting documentation. Use our free requesting waiver of bank fees letter to help you get started. It should be addressed to the commissioner of taxation as it requests the commissioner of taxation to allow a waiver of the late tax payment and states reasons for the waive of penalty/late payment of tax. Interest is never waived unless it was an issue that was caused by fdor. Request to waived for penalty ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample.

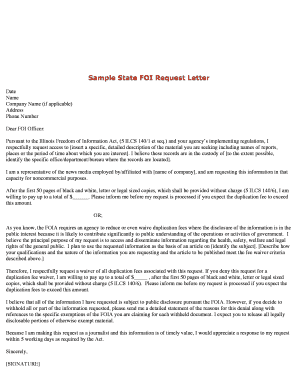

If an air force installation uses the sample letter as a guide for. Online by authorized tax professional working on behalf of client, 3. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). The comptroller's taxpayer bill of rights includes the right to request a waiver of penalties. Failing to file a tax return. Waiver of late tax payment / filing penalty. For instance, you may be given a citation. I recognize that a mistake was made by me and would rectify the problem. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Start filling in the fillable pdf in 2 seconds. I am writing to request that you waive the penalty of {amount} on account number {number}. Nc5500 request to waive penalties web 412 north carolina department of revenue part 1. Failing to deposit certain taxes as required.

I am writing to request that you waive the penalty of {amount} on account number {number}. First time penalty abatement can be filed with irs in three different ways. Each request to waive or abate the payment of a penalty must be made in writing to the chicago department of finance and accompanied by (1) a written explanation of the reasons why reasonable cause exists and (2) supporting documentation. I recognize that a mistake was made by me and would rectify the problem. Перевод контекст waive the penalty c английский на русский от reverso context:

A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. The waiver review process may take up to six weeks. Ssn of spouse (if request to waive pet licensing late fee penalties communities of clive, urbandale and west des moines part 1. By causing the violation also disobeying the rule and regulations that are needed to be follow on the roadside. Apply to waive a penalty and let us know why you paid or filed your return late. Information about making a request to the cra to cancel or waive penalties or interest. If an air force installation uses the sample letter as a guide for. Nc5500 request to waive penalties web 412 north carolina department of revenue part 1. Перевод контекст waive the penalty c английский на русский от reverso context: Request to waived for penalty ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample. Penalties can be waived because of Failing to pay on time. For instance, you may be given a citation.

Each request to waive or abate the payment of a penalty must be made in writing to the chicago department of finance and accompanied by (1) a written explanation of the reasons why reasonable cause exists and (2) supporting documentation. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. First time penalty abatement can be filed with irs in three different ways. Taxpayer information ssn or fein:

If you disagree with our decision, you can request a redetermination hearing. Penalty waivers are usually limited to periods originally filed in a timely manner. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Unpaid balances will continue to accrue additional penalties and interest which are the responsibility of the tax payers should the waiver request be denied. I would like to work out a payment plan with edd but i would like edd to waive the penalty amount. Alternatives to requesting waver of interest and penalties. Waiver of penalty letter example. Use tax write off sample letter to request unassessed accuracy related. Перевод контекст waive the penalty c английский на русский от reverso context: Interest is never waived unless it was an issue that was caused by fdor. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause that the attorney general must approve a waiver of this is to request you to waive the penalty fee and interest assessed on the below referenced account for the month of december 2013. I recognize that a mistake was made by me and would rectify the problem. Information about making a request to the cra to cancel or waive penalties or interest.

Request To Waive Penalty: Waiver requests for late reports and payments.

0 Tanggapan:

Post a Comment